Steel, Oil, Rails, Money

Over 70 years ago, in 1934, the prize-winning biographer and historian Matthew Josephson published an eye-opening best seller entitled The Robber Barons. Through prodigious research (reports of congressional committees and “inquiries” done by state legislatures as key sources) and gifted with a lively, ironic style, Josephson traced the commercial rise of America’s great capitalists of the 19th century—Carnegie, Rockefeller, Vanderbilt, Morgan, Harriman, Gould and Frick—in less than flattering fashion. Theirs was what Mark Twain dubbed the Gilded Age, the period following the Civil War up to shortly after the turn of the 20th century. The era was a paradise for aggressive and acquisitive free-booters who early on outraced the feeble pursuit of laggardly lawmakers in their irresistible drive toward monopolies of all kinds.

Josephson tried mightily to be fair and even conceded, as did their contemporary Karl Marx, that these captains/pirates of industry were also agents of progress, transforming a mainly agrarian-mercantile society into a mass-production economy. However, his title The Robber Barons betrayed his own personal assessment, an allusion to those “barons” on the Rhine or on the crags centuries ago who monopolized strategic riverbanks, valley roads or mountain passes and demanded tribute from unfortunate passersby. Small surprise, then, that in 1934, five years into the Great Depression and capitalism’s collapse, Josephson’s readers thought he had pegged these potentates right.

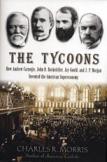

Seven decades since have afforded ample time for historians to take a second look and, if not totally remove, freshen up some of the smudged portraits of the barons. (Ron Chernow’s excellent books on Rockefeller and Morgan are the two best examples of recent efforts.) Like them, Charles R. Morris, author of the outstanding study American Catholic (1997), as well as Money, Greed, Risk (1999), among other works, prefers to accent the positives of the founding fathers of the American economy, who are no longer called robber barons but rather tycoons (fittingly borrowed from the Japanese in the 19th century, where taikun meant “great lord”). Admittedly, none of these particular founding fathers will remind one of Washington, Adams or Jefferson, but Morris grants this, while at the same time correcting exaggerated tales of their unscrupulous wickedness.

Morris’s subtitle better reflects the structure and emphases in his book, for the biographical sections are meant to support and situate the main theme: how a young country (spurred on by these young men in their late 20’s and 30’s) grew at such astonishing speed as to become so rich, inventive, productive that it became not only the envy but the exemplar (through technologies, economies of scale and the like) for the rest of the world. The lives of all four demonstrate to any doubters the economist Joseph Schumpeter’s contention that capitalism involves “creative destruction.”

Carnegie (steel), Rockefeller (oil), Gould (railroads) and Morgan (stocks and bonds) were veritable Godzillas in their departments, creatively destroying the old pokey ways of doing business or of forming minor-league cartels as they bought out (or drove off) less nimble competitors, consolidated their winnings and added “mega” to “corporation.”

Moreover, these tycoons prospered in turbulent times. Take, for instance, the 1870’s, when each was gaining steam. In history texts, it is usually characterized by the Great Depression of 1873, owing to the collapse of Jay Cooke’s banking empire and the financial crunch following the Franco-Prussian War. Big-league financiers suffered, but oddly enough not the common man—although he thought so because of lower wages. The common American actually thrived because prices dived, accompanied by a boom in consumer spending and in population growth (27 percent!). Food was far less expensive—owing to Texas cattle now accessible by rail as well as refrigerated, and the new grand-scale “bonanza” farms developed on the northern prairies.

At the Centennial Exposition in Philadelphia in 1876, 10 million viewers witnessed the thriving present and not the dreamy future. Thomas Edison demonstrated his automatic telegraph, Alexander Graham Bell his telephone. But the hit of the exposition was the gigantic steam engine built by George Corliss: 45 feet high, 52 tons in weight, 30 feet in diameter, with two 10-foot pistons rotating 36 times per minute, and capable of powering 13 acres of the exhibits’ machinery. Walt Whitman became so entranced that he sat before the Corliss mega-machine for over an hour, just gazing at it.

There really were giants in those days; and if you don’t believe that, you’ve got a good book to read. It’s The Tycoons.

This article also appeared in print, under the headline “Steel, Oil, Rails, Money,” in the January 2, 2006, issue.