Gun laws and gay rights notwithstanding, perhaps the biggest differences among the 50 states have to do with how they fund themselves. In Oregon, an individual income tax pays for most services, which puts more of a burden on high-income households. Next door in Washington, sales taxes pay for most everything, which punishes families that spend more of their income (i.e., the poor) and rewards those who can park more of their money in savings or investments.

Last week the Census Bureau released data on how much each state raised from various taxes in fiscal year 2014, and though no two states have the same revenue recipe, there are some patterns that suggest new and old (maybe centuries-old) judgments on who should be asked to pay more.

The Census reported a shift in the tax burden from high-income to high-spending households last year, with total revenue from general sales taxes increasing by 4.8 percent and revenue from income taxes going up by a more modest 0.4 percent.

But there are big differences at the state level. In Kansas, site of what Republican Gov. Sam Brownback has called “a real live experiment” in trying to boost the economy by slashing income taxes, revenue from those income taxes fell by 15.0 percent last year while revenue from sales taxes rose by 3.0 percent. (The hit to the state treasury has caused Brownback to suggest slowing down his series of tax cuts.) The biggest shift in the tax burden was in Ohio, where income tax revenue fell by 14.6 percent and general sales tax revenue rose by 18.4 percent. Income tax rates in that state have fallen under Republican Gov. John Kasich, who has proposed eliminating the income tax entirely.

Kansas and Ohio are the only states where sales tax revenue overtook income tax revenue last year (there were no changes in the opposite direction), but income tax revenue dropped while sales tax revenue also rose in 16 other states. The declines in income tax revenue could signal a weak economy in some cases, but the tax cuts in Kansas and other states clearly made a difference. Four states—Arizona, Georgia, Hawaii, and Utah—bucked the trend and saw higher revenue from income taxes but lower revenue from sales taxes (perhaps because high population growth has netted more high-income individuals).

Here are some of the broad strategies for raising state revenue, with examples of the states that have chosen them:

Soak the rich. Oregon gets 69 percent of its revenue from individual income taxes, the highest in the U.S., and its top rate of 9.9 percent is higher than in any state except California and Hawaii.

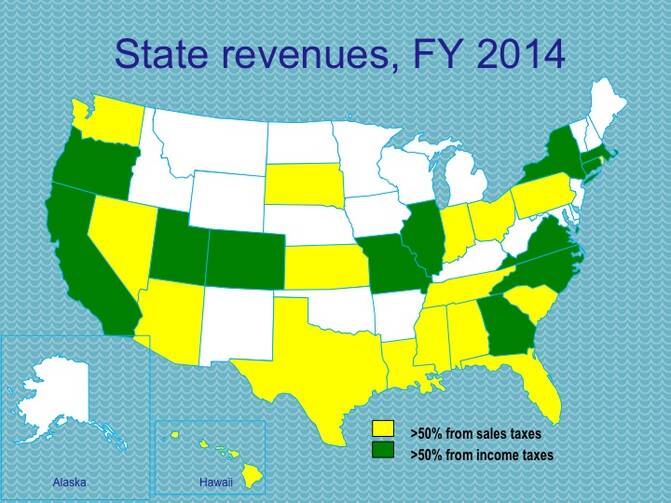

Besides Oregon, this category includes California, Colorado, Connecticut, Georgia, Massachusetts, Missouri, New York, Utah, and Virginia. All get at least 45 percent of their revenue from individual income taxes. Georgia is something of a surprise on this list, since Republican and Southern states both lean toward a greater reliance on sales taxes, but history may provide an explanation. Nineteen states rely more on general sales taxes than individual income taxes, but none are among the original 13 states. Newer states may have been more likely to enact low income tax rates, or go without income taxes entirely, as a way of enticing people to move to deserts, swamps, and other uninviting areas.

Soak the spendthrifts (also known as the poor). Florida gets 61 percent of its revenue from its general sales tax (6 percent), more than any other state. (See FiveThirtyEight.com for a table and maps that rank the states in various revenue categories.) Wealthier households need not fear that their taxes will go up whenever Florida faces a budget crisis, for the state has no income tax at all.

Besides Florida, this category includes Nevada, South Dakota, Tennessee, Texas, and Washington, all of which get more than 40 percent of revenue from the general sales tax and have no income tax. (Tennessee taxes only dividends and interest.) Alabama and Mississippi are also in this category because they are the only two states that don’t exempt non-restaurant food from the sales tax or offer a tax rebate to poorer households to compensate for the tax paid on food.

Soak the tourists. Hawaii gets a lot of tourists, so making them pay for state services is an irresistible proposition. After all, visitors to the islands can’t complain to their legislators back home about the 4 percent sales tax here. Florida and Nevada, in the previous category, also get a lot of money from tourists, but Hawaii doesn’t let its most affluent residents off the hook. It has among the most progressive income taxes in the nation, with 12 income brackets and a top rate of 11.0 percent. So although Hawaii’s primary source of revenue (47 percent of its total) is the general sales tax, it tries not to put too much of the burden on its low-income citizens.

Besides Hawaii, this category includes Arizona, Idaho, New Mexico, and South Carolina, all of which get more than 35 percent of their revenue from sales taxes but also have progressive income taxes that disproportionately affect wealthier residents—who, in many cases, have moved from somewhere else and will always be “tourists” to the natives.

Soak the selective (or the sinful). West Virginia gets 25 percent of its revenue, the nation’s fourth highest, from “selective” sales taxes. These are also known as “sin taxes” because many ostensibly discourage unwanted behavior, or at least keep it under control (though a state doesn’t want a revenue source to disappear). West Virginia taxes beer at 18 cents per gallon, wine at $1 per gallon, cigarettes at 55 cents per pack, and soft drinks at one penny per half-liter, with another 80 cents per gallon of soft-drink syrup. The state also taxes gasoline at 35 cents per gallon (well, some consider excessive driving a sin), and West Virginia is among the states most dependent on revenue from the lottery (and it certainly doesn’t want its residents to spend less on tickets).

Besides West Virginia, this category includes Rhode Island, which has the second-highest cigarette tax ($3.50 a pack, behind New York’s $4.35) and the second-highest per-capita revenue from the lottery (behind Massachusetts); and Pennsylvania, which has the highest gasoline tax (51.6 cents per gallon). It also includes New Hampshire, which can go without a general sales or income tax because it gets 38 percent of its revenue from “selective” sources, the highest in the nation. New Hampshire’s array of selective taxes target not only cigarettes, restaurant meals, and hotel rooms, but also utilities, real estate transfers, timber, and “gravel” (that is, the amount of dirt excavated in development projects).

Selective taxes seem to be particularly popular in states along the Appalachian Trail, with Alabama, Kentucky, Tennessee, and Vermont also getting more than 20 percent of revenue from such sources. Perhaps there’s a deeply rooted anti-tax sentiment in the region that causes states to avoid broad-based levies in favor of sneakier, or less obtrusive, sources.

Soak the oil companies. Alaska has no income or sales tax, thanks to “severance taxes” on the extraction of oil and natural gas. North Dakota is the only other state to get most of its revenue from severance taxes in FY 2014. Nice work if you can get it.