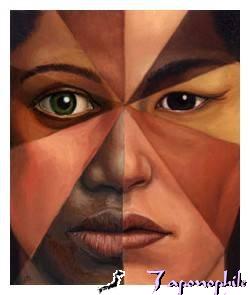

Whatever one thinks of the “trickle down theory” of economic growth, this much is clear: the economic burdens of the Great Recession have not trickled down, but have rained down like a deluge soaking some groups much more than others. Between 2005 and 2009, Hispanic and black families lost more of their net worth than did white families. And the disproportionate loss has caused the wealth gap between these groups and whites to grow.

Whatever one thinks of the “trickle down theory” of economic growth, this much is clear: the economic burdens of the Great Recession have not trickled down, but have rained down like a deluge soaking some groups much more than others. Between 2005 and 2009, Hispanic and black families lost more of their net worth than did white families. And the disproportionate loss has caused the wealth gap between these groups and whites to grow.

The contrast is stark: white households lost 16 percent of their median net worth during the period, while Hispanic families lost 66 percent and black families lost 53 percent of theirs. These findings are included in a study by the Pew Research Center titled “Twenty to One.” The title refers to a startling fact: in 2009 the median net worth of white families grew to be 20 times that of black families (and 18 times that of Hispanic families). For the 20 years prior to the onset of the recession, however, both numbers were only half as high. The recession has doubled the wealth gap between these minority groups and their white neighbors.

The reasons are no mystery. As groups, blacks and Hispanics had less equity in their homes and owed more debt (both mortgage and credit card debt) than whites; and home ownership made up a larger portion of their total net wealth. Whites by contrast owned more cars, stocks and mutual funds and had more in pensions and savings. Also, a disproportionate number of Hispanics live in the Sunbelt states, where the housing crisis hit hardest.

For readers concerned about the difficulties of poor and middle-class Americans struggling to get ahead, and for readers who find widening class differences antithetical to the common good, this recession has been a big, and unequal, blow.

(For the data on Asian Americans, see In All Things, Asian Americans Lose Top Spot, Aug. 9)

The implied statement of a problem in this article does not making sense. The article states that a wealth gap exists and therefore that is a problem. But why should a wealth gap be a problem? Are all people at all time in a society of 350 million people expected to have about the same amount of wealth? How incredibly unrealistic would that be? Or if gaps are allowed are they limited somehow to by some unknown rule of some maximum ratio of wealth between all goups in America? Asian Americans can not be allowed more wealth than 20 to 1 to any other group? How unreasonal a standard would that be? l How is a person of a one race or ethnic group harmed by someone else being even is millions of times more wealthy?

This article states an ecconomic realtionship and implies that this relationship between groups is somehow a problem without stating how and why aanyone should care.

Taxing the rich is a diversion from stopping job killiing, run-away government taxing and spending that is killing the economy. 37% of a GDP is going to local, state and federal government up from 26 %ten years ago. Taxing the rich will not stop the job killing growth of the public sector; it will only enable the federal government to become even more bloated and ineffective.

Jobs and in fact whole new industries such as computers, and internet services are created in the private sector by the tons. There is an abundance of new technology to bring on line. If you want jobs you make sure the private sector has the capital it needs to go to work and of course is allowed to keep the fruits of its labor. Jobs provide employment soemthing we have not seen for quite awhile. But from the 1980s rhrough 2005 whole new industires created jobs in the private sector by the tens of millions. Tax revenues flooded the Treasury from ordinary working people with jobs. No need to tax the rich thank you very much they are doing just great by investing and establshing new industries which created an abundance of new jobs. They just do not deserve to be punished for being so successful at what they do so well. I wish we had more rich guys and girls.

The last time we had unemployment steady at 9 plus percent was under Jimmy Carter when the public sector was bloated and taxes were sky-high for everyone.

Job creation by the private sector is what America does very well if it is allowed to. We do not need the 1930s failed Keynesiuan governnment managed economy that waste e a lot of money but produce no new jobs.

As they say Ed government is not the solution, government is the problem. More taxes to government takes money out of the private sector and makes the public sector bigger. If your serious about creating jobs and we are you do not allow the public sector to grow by rasing taxes at the expense of the private sector. We are talking about serious private sector job creation.

The pot calling....

I knew when I read this thread, the partisans would be out in force; more blogdom spin.

The ideology that drives me is freedom, justice and Catholicism. To those things I plead guilty.

Question... what motivates GOP/TP wannabees to keep the rich richer and pay at a rate lower than the working stiff. ???. I'm truly baffled.

GOP/TPers should start to get their 'no tax for the super rich' augments sharpened up and a bit more comprehensible because that is what the next 16 months is going to be all about. If paying off the 14trillion debt is to be paid only on cuts ... 'show me the money'

http://finance.yahoo.com/news/Warren-Buffett-Pushes-bloomberg-4088896717.html?x=0&sec=topStories&pos=4&asset=&ccode=

By the way, did Buffet voulenteer to pay higher taxes. He has that option but chose to pay lower taxes. He could have led by example. What a hypocrite.

I just listened to your online commentary. As you correctly note, the largest cause of the inequal erosion of wealth is home equity and loss of value. I would urge, in light of this fact, to read and review Gretchen Morgensen's book "Reckless Endangerment." Morgensen is a New York Times reporter and her book documents the impact of progressive politics and politicians like Barney Frank & Fannie and Freddie's role in getting poor people to buy homes they could not afford.

This would be a great book for someone at America to review!